Organised By

Visionaries who graced GFF2025 with their presence

Shri

Narendra Modi

Hon'ble Prime Minister

The

Rt Hon Sir Keir Starmer

Prime Minister of the United Kingdom

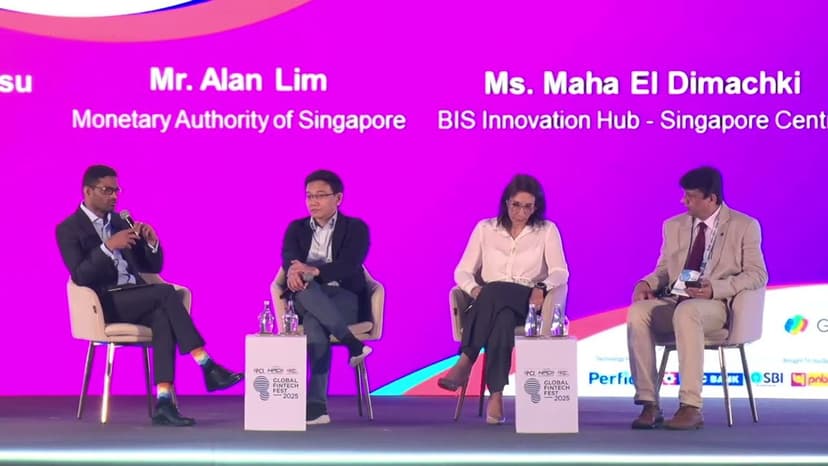

GFF 2025 Speakers

GFF 2025 featured the sharpest minds in fintech.

Smt.

Nirmala Sitharaman

Hon'ble Minister of Finance & Corporate Affairs, Government of India

Shri

Piyush Goyal

Hon'ble Minister of Commerce & Industry, Government of India

Shri

Devendra Fadnavis

Hon'ble Chief Minister of Maharashtra

Shri

Sanjay Malhotra

Governor, Reserve Bank of India

Shri

Tuhin Kanta Pandey

Chairman, Securities and Exchange Board of India

Shri

Kalyanaraman Rajaraman

Chairperson, International Financial Services Centres Authority

Dr.

Saurabh Garg

Secretary, Ministry of Statistics and Programme Implementation, Government of India

Shri

M Nagaraju

Secretary, Department of Financial Services, Ministry of Finance, Government of India

Mr.

Francois Villeroy de Galhau

Governor, Banque de France

Mr.

Burkhard Balz

Member of the Executive Board of the Deutsche Bundesbank, Deutsche Bundesbank

Mr.

Ulrik Nødgaard

Governor, Denmark National Bank

Ms.

Débora Sztarcsevszky

General Secretary Manager, Central Bank of Uruguay

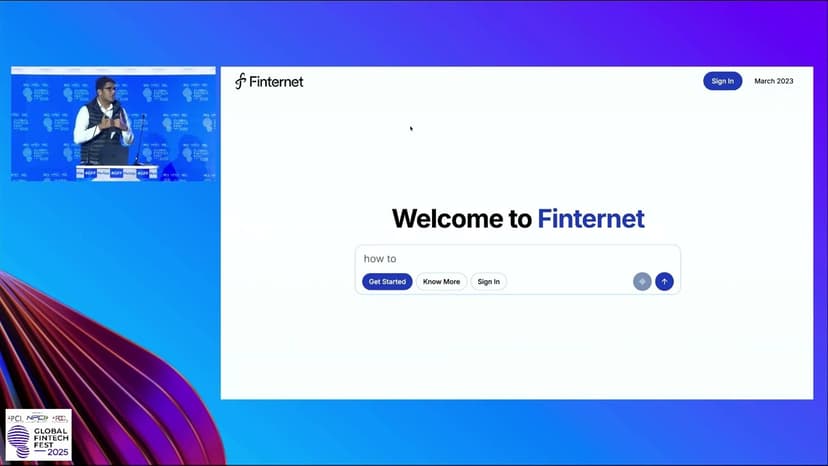

Powering the Next Wave of Financial Innovation

The 7th Global Fintech Fest in September, 2026 is more than just a conference. It’s the world’s largest fintech festival, bringing together the sharpest minds to chart out a better future powered by AI. Inspiring, innovative, invigorating, the GFF journey is a commitment to shared prosperity and growth opportunities.

0+

Footfall

0+

Participating Companies

0+

Speakers

0+

Investors

0+

Exhibitors

0+

Sessions

0+

Participating Countries

0+

Product Launches & Showcases

0+

Workshops, Masterclasses

0+

Networking Sessions

0+

Closed Room Sessions

0+

Report Launches