.png)

.png)

This second edition of the Global FinTech Festival (GFF) has been specifically conceptualised to harness some of the best minds to deliver strategic insights on the current transformation of the ecosystem globally, position strategic activations to attract higher investments, derive a future-proof road map and upscale the knowledge base.

With the theme FinTech: Empowering a Global Digital Economy, GFF 2021 will provide an in-depth understanding of the latest business, policy, investment and technology developments within the FinTech landscape globally. We look forward to three insightful days on conferencing, Expo and Startup engagement.

The world is growing through the largest digital transformation, as an offset of COVID-19. There has been a major overhaul in the functionality of top industry verticals, specifically the BFSI domain which has been witnessing a rapid transition over the last few years.

The FinTech market has continued to help expand access to financial services during the pandemic, especially, the emerging market has seen strong growth in all types of digital financial services.

Access to affordable financial services is critical for poverty eradication and economic growth. For poor people, especially women, access to and use of basic financial services can raise incomes, increase resilience, and improve their lives.

FinTech innovations are helping reduce the cost of providing services, making it possible to reach more people, and reducing the need for face-to-face interactions, essential for keeping up economic activity during the pandemic.

This second edition of the Global FinTech Festival (GFF) has been specifically conceptualised to harness some of the best minds to deliver strategic insights on the current transformation of the ecosystem globally, position strategic activations to attract higher investments, derive a future-proof road map and upscale the knowledge base.

With the theme FinTech: Empowering a Global Digital Economy, GFF 2021 will provide an in-depth understanding of the latest business, policy, investment and technology developments within the FinTech landscape globally. We look forward to three insightful days on conferencing, Expo and Startup engagement.

Honorable Minister of Finance and Corporate Affairs

Minister of State in the Ministry of Skill Development and Entrepreneurship; and Ministry of Electronics and Information Technology

Piyush Goyal (57) is the Minister of Commerce & Industry (2019-present), Consumer Affairs, Food & Public Distribution (2020-present), Textiles (2021-present), and Leader of the Rajya Sabha (2021-present). He was earlier the Minister of Railways (2017-21). He has also held the additional charge of Minister of Finance and Corporate Affairs twice in 2018 and 2019. His previous portfolios include- Minister of Coal (2014-19), Minister of State (I/C) for Power, New & Renewable Energy (2014-17), and Mines (2016-17). As Minister of Railways, over the last two years of his tenure Railways achieved its best ever safety record of zero passenger deaths in accidents. This was achieved through holistic measures such as elimination of Unmanned Level Crossings (UMLCs) from the broad gauge network, production of safer coaches etc. Additionally, Mr Goyal oversaw the launch of the first indigenous semi-high speed train Vande Bharat Express between Delhi and Varanasi. The Power, Coal and New & Renewable Energy ministries led transformational changes in India’s power sector including the fast tracking of electrification of the nearly 18,000 unelectrified villages in some of the remotest and inaccessible parts of the country, the roll out of the most comprehensive power sector reform ever (UDAY), the success of the world’s largest LED bulb distribution programme (UJALA) for energy efficiency, and massive proliferation of renewable energy through the world’s largest renewable energy expansion programme. Other achievements include the elimination of coal shortages to improve the energy security of India and successful conduct of transparent e-auctions of coal blocks. He also received the 4th Annual Carnot Prize in 2018 recognising the pathbreaking transformations in India’s energy sector. During his 35 year long political career, Mr Goyal has held several important positions at different levels in the world’s largest political party, the Bharatiya Janata Party (BJP) and is in its National Executive. He has been the National Treasurer of the Party. In the 2019 Indian General Elections, he was a member of the Manifesto and Publicity Committees. He also headed the BJP’s Information Communication Campaign Committee for the Indian General Elections 2014. Mr Goyal has had a brilliant academic record – all-India second rank holder Chartered Accountant and second rank holder in Law in Mumbai University. He was a well-known investment banker and has advised top corporates on management strategy and growth. He also served on the Board of India’s largest commercial bank, the State Bank of India and Bank of Baroda. He was also nominated by the Government of India to the Task Force for Interlinking of Rivers in 2002. His father, Late Vedprakash Goyal was Union Minister of Shipping, and the National Treasurer of the BJP for over two decades. His mother Chandrakanta Goyal was elected thrice to the Maharashtra Legislative Assembly from Mumbai. He is married to Seema, an active social worker, and has two children – Dhruv and Radhika, who have both graduated from Harvard University, USA.

Shri Rajeev Chandrasekhar

Minister of State in the Ministry of Skill Development and Entrepreneurship; and Ministry of Electronics and Information Technology

Profile

Educational Qualifications

Professional History

Intel at Silicon Valley. California, USA

Senior Design Engineer and then CPU Architect at Intel’s Microprocessor team Was on the Intel 80486 Design team and then on the Architecture team of the path-breaking Pentium team. Worked under legendary Vin Dham and current Intel CEO Pat Gelsinger.

Entrepreneur and builder of India’s Cellular Sector

BPL Mobile 1994 – 2005

In 1991, he returned to India and founded BPL Mobile in 1994 was one of pioneers to invest in and build the Indian Telecom sector. Over those 12 years Rajeev has been a widely recognized and key active participant/contributor in the development of the Indian Telecom sector from a government monopoly dominated one to a vibrant success in the Indian infrastructure sector.

He built India’s then-largest Cellular network and being the first to and simultaneously deliver this Technology to Mumbai, Kerala, Puducherry, Goa, Tamil Nadu, Maharashtra when almost all others were doing so in one or two small markets.

He was a significant contributor to the creation of Independent regulator TRAI and the New Telecom Policy NTP’99 that led to dramatic growth and success of the Cellular Sector.

He was a significant contributor to the creation of Independent regulator TRAI and the New Telecom Policy NTP’99 that led to dramatic growth and success of the Cellular Sector. He remained invested and active in the sector and was the only one not to be embroiled in any of the scams and corruption that gripped the sector. Exited the sector when he saw the advent of Raja Raj in 2006.

Investor and Entrepreneur

Jupiter Capital

Founded Jupiter Capital as a private equity investor in 2006 and was Chairman till 2014.

Has invested and created many successful brands and franchises in Media, Technology, Infrastructure

Vivekananda International Foundation

Vice Chairman, Center for Economic Studies: 2019- Present

Political: 15 years of Rajeev Chandrasekhar as MP

Opposition MP From 2006- 2012

2G- In 2007 was the first to raise 2G Scam issue in Parliament. At great personal risk, he was the only person to push back against the heavy lobbying and pressure of Telcos including big names on the issue of Spectrum Auction. He was single-handedly responsible to ensure the 3G auction despite a concerted campaign in Media and in Parliament. The resulting 3G auction served to expose the value of free 2G spectrum being given away and the Country today generates lakhs of Crores from these auctions which otherwise would have accrued in value to these Telcos. Fighting the 2G scam was done as Independent MP at great personal risk and cost.

PIL for Section 66A- He was first to raise it in Parliament and oppose UPA’s misuse of draconian Sec 66A of IT Act. Raised it repeatedly in Parliament and got media awareness on this. Was active petitioner in the PIL in the Supreme Court that struck down Sec 66A. Was nominated for Index Freedom of Expression award for year.

Petitioner for Right to Privacy- Leadership on the issue of Privacy started way back in 2010 with his Pvt Member’s Bill- Right to Privacy Bill, 2010 and he consistently fought for the Right to Privacy despite much opposition to it in the Media and was a petitioner and supporter of the PIL that created the landmark Right to Privacy judgement.

Free and Open Internet, Net neutrality

On two critical issues, opposed the UPA governments move to restrict and change the nature of the Internet. On-Net neutrality, opposed the UPA governments efforts to allow Telcos to control and regulate access to the Internet and ensuring that the TRAI and Government reversed the Telco inspired move – in Parliament and through a mass public campaign outside Parliament.

Also single-handedly created awareness about and stopped the Manmohan Singh Government’s efforts to back China’s attempt to move Global Internet regulation to a United Nation Bureaucratic organization UN-CIRP. It took Narendra Modi Government to finally reverse this position and continue to allow the Internet to be a free and open global network without Government control.

Aadhaar

From 2009 was the sole voice in and outside Parliament to oppose the UPAs Aadhaar architecture and design – including lack of legislative backing, lack of Privacy protection, lack of integration with National Population Register and its very dangerously lax verification process. All of which were finally addressed only after PM Narendra Modi became PM.

Public sector Bank NPAs- In 2010 he was the first to raise NPA issue and Crony lending by PSBs lending to favourite UPA Corporates till 2014. Written and spoken extensively about reforms in the banking sector in particular, financial sector expansion and the role of RBI.

OROP- Since 2006, Single-handedly pushed the OROP issue in and outside Parliament, including piloting a Parliament Petitions Committee Report that found in favour of OROP.

Voting Rights for the Indian Armed Forces - After repeated efforts with EC and then Government failed, approached the Supreme Court via a PIL and ensured he got voting rights for armed forces and families. He also pushed EC to ensure remote units could vote. Voter turnout of armed forces has increased in state elections in Uttarakhand and UP.

National War Memorial- From 2007 as MP kept urging Government to set up National War Memorial and this dream became a reality when Narendra Modi became PM. As the then Congress Government was blocking this, initiated a National Military Memorial in Bengaluru.

Kargil Vijay Diwas – In 2009 raised the issue of Kargil Vijay Diwas and ensured that the Government agreed to start celebrating that formally.

Supporting Bravehearts and their families- Repaired and reconstructed CQMH Abdul Hamid’s memorial when the then Government failed to intervene and protect PVC Braveheart’s memorial. Through Flags of Honor Foundation, has helped countless scores of Veteran and Braveheart families all over the country.

Honoured by Army’s Western Command GOC-in Commendation for his work for the Armed Forces and Veterans.

Karnataka Floods: In 2009 Conceived and executed with the Government of Karnataka, an unprecedented public-private initiative ‘Aasare’ – to help rebuild the thousands of destroyed homes and villages in the Floods. He succeeded in roping more than 50 corporates who committed to build 80,000 houses for the flood-affected families. He personally adopted three villages and build several hundred homes.

Plan Bengaluru- in 2009-2010 who worked for a vision for Bangalore and a long-term integrated plan for the development of the city. As the Convenor of the Agenda for Bengaluru Infrastructure and Development (ABIDe) Task Force, he authored PlanBengaluru2020 - a Vision Document and a blueprint for the development of the city to make Bengaluru a world-class metropolis. This remains the first and only such plan for Bengaluru or any other city in the country. Through his NGO NBF, has done many initiatives for Bengaluru including reclaiming encroached lakes and land from builders, Protecting Residential neighbourhoods, Environment, Fighting City corruption, Rewarding Good citizen Organizations and Public servants etc.

Treasury MP From 2014- 2018

RERA- Served on Select Committee of RERA Act and pushed actively to protect home buyer rights as per the vision of the PM, despite huge lobbying by real estate lobby to scuttle or weaken the bill. Also responsible for the draft rules to be created along with citizens interaction with ministry

GST- Served on a select committee of GST and also in financial and regular media advocacy for these reforms and positioned it as a reformer for the long term which will increase tax compliance.

Economic Policy Advocacy- Actively spoke in parliament on each budget from 2006- 2021. Have spoken about 5 Trillion Dollar Economy roadmap and initiatives required in Parliament, in committees and in various Articles. Participated in almost every Budget discussion and has consistently advocated Investment and Economic growth as the main answer to transforming the lives of Indians poor and Vulnerable.

Aadhar- Made many suggestions to this government to improve Aadhar so that it can be used to fulfill PM’s vision. Even had meetings with Aadhar to explain the safeguards required.

Digital Consumer Rights, Call Drops, Net Neutrality- Consumer Protection and Rights- he was first to raise in Parliament and mobilize public opinion. He has pursued the cause of the consumer relentlessly till the current situation where TRAI and the government are fully supporting his consumer position. He has personally responded in detail to every major TRAI consultation with his suggestions in an open and transparent manner.

Cryptocurrencies- Flagged in 2016 the emerging challenges of regulating Cryptocurrencies.

Digital India (New Digital Communication Policy)- strongest advocate for the government’s digital India program. Contributed in large part to the proposed draft digital communication policy on the 25th anniversary of Telecom liberalization.

Big Tech Regulation Was the earliest MP to recognize the power of Social Media and Tech Platforms and start a debate in and outside parliament about the need to regulate them, Policy advocates in and outside Parliament on all issues relating to Technology, including the need to regulate Big Tech.

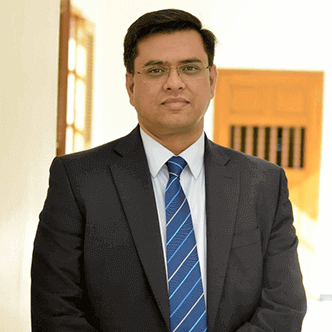

Krishnamurthy Venkata Subramanian (born May 5, 1971) is an Indian economist and the current Chief Economic Adviser to the Government of India (CEA), officially being appointed to the position on 7 December 2018. The post of CEA was vacant for over five months since the 16th CEA, Arvind Subramanian, left due to personal reasons in June 2018, having occupied the position for a few months more than the usual term of three years.

Subramanian is also a Professor at the Indian School of Business (ISB). He was awarded "Professor of the Year" by ISB for elective courses that he taught for the Class of 2019.

He was born in Bhilai, Chhattisgarh in a Tamil family. He did his schooling at senior secondary school sector 10, Bhilai. Subramanian holds a Master of Business Administration and Doctor of Philosophy (PhD) in financial economics from University of Chicago Booth School of Business. His PhD was completed under the supervision of Luigi Zingales and Raghuram Rajan. He is also an alumnus of the Indian Institute of Technology, Kanpur where he studied electrical engineering, as well as the Indian Institute of Management, Calcutta, where he was awarded an Ewing Marion Kauffman Foundation Dissertation Fellowship in 2005.

Subramanian has worked in expert committees for Securities and Exchange Board of India and the Reserve Bank of India, being part of major economic and corporate reforms in India. He has worked with JPMorgan Chase, ICICI Bank and Tata Consultancy Services. He was a board member in Bandhan Bank, the National Institute of Bank Management and the Reserve Bank of India Academy, and has academically been a part of the finance faculty at Goizueta Business School at Emory University in the United States of America.

Subramanian is also currently a tenured Professor at the Indian School of Business, and earlier worked as an executive assistant to the chairperson of the Fixed Income Money Markets and Derivatives Association of India.

In articles published in The Times of India and Livemint titled, "Will Black Be Back? Why demonetisation will be revolutionary in India’s fight against corruption", and "Demonetisation: Are the poor really suffering?", respectively, Subramanian supported the Government of India's banknote demonetisation policy in 2016.

Subramanian was inducted into the Fifteenth Finance Commission's advisory council in May 2019.

Mr Tobias Adrian is the Financial Counsellor of the International Monetary Fund and its Director of the Monetary and Capital Markets Department. The Monetary and Capital Markets Department encompasses capital markets, monetary policy and central bank operations, financial crises and resolution, financial sector assessments, technical assistance, supervision and regulation, and monetary and financial stability policy.

Prior to joining the International Monetary Fund, Tobias Adrian was a Senior Vice President of the Federal Reserve Bank of New York and the Associate Director of the Research and Statistics Group. Tobias Adrian holds a PhD from MIT, an MSc from LSE, and a Masters degree from Goethe University of Frankfurt and Dauphine University of Paris.

Tobias has taught at Princeton University and NYU and has published in economics and finance journals including the American Economic Review and the Journal of Finance.

Shri T. Rabi Sankar, a career central banker joined the Bank in 1990 and has worked in various positions in the Reserve Bank of India.

His current areas of responsibility include reserves management, public debt management, payment systems, IT infrastructure, currency management and foreign exchange management.

Shri Sankar has served as an IMF Consultant (2005-11) on developing Government bond markets and debt management.

He has represented RBI on international forums like Bank for International Settlements and various internal and external expert committees and working groups.

Shri Sankar has a Master of Philosophy in Economics from the Jawaharlal Nehru University, New Delhi.

Mr Gurumoorthy Mahalingam is a Whole Time Member (Executive Board Member) of the Securities and Exchange Board of India (SEBI) looking after the Market Regulation Department, Commodity Derivatives Market Regulation Department, Foreign Portfolio Investors, Investigations Departments and the Office of Investor Assistance and Education. He is also at present a Member of the Board of Governors of the National Institute of Securities Market (NISM).

Prior to the current assignment, Mr Mahalingam was an Executive Director in the Reserve Bank of India (RBI) looking after the Market operations, both Rupee liquidity and FX operations. In his stint of 34 years with RBI, he has taken on varied roles like Chief Forex Dealer, Chief Investment Dealer for Forex Reserves Management, Head of Debt Management. He has also been actively involved in the regulation and development of Money, Bond and Foreign Exchange and Derivative markets in India. His prior assignments in RBI include Bank Examiner as also a Member of Teaching Faculty in RBI's Officers' Training College.

He is a Masters Degree holder in Statistics and Operations Research from the Indian Institute of Technology, Kanpur and M.B.A in International Banking and Finance from the Birmingham Business School, UK.

Sopnendu Mohanty is the Chief Fintech Officer of the Monetary Authority of Singapore (MAS). He joined MAS in August 2015 responsible for creating development strategies, public infrastructure and regulatory policies around technology innovation. Since 2015, Singapore has become one of the top global fintech hubs covering a wide range of financial asset classes including adjacent technology innovations in areas like insurance, digital assets, blockchain, artificial intelligence, reg-tech and green-finance.

Before MAS, Sopnendu spent over 20 years in various leadership roles in technology, finance and innovation with most of his career in Citigroup. Sopnendu is a member of multiple advisory committees of multilateral global agencies, associations, universities, and governments. He is an avid speaker, global thought leader in FinTech, and advocate of accelerated transformation to a digital economy for solving financial inclusion and sustainability challenges.

Gopalaraman Padmanabhan, (DB: 29/05/1955) a post graduate in Economics from Kerala University and a Masters in Business Administration from the Birmingham Business School holds extensive experience and expertise in bank regulation and supervision, development of foreign exchange/securities markets in India, information technology and payment systems, with more than 35 years of experience with the RBI in various capacities i.e. recommending and implementing policies, systems, guidelines and regulations relating to the banking, financial services and securities sector of the country.

Padmanabhan was the Chairman of the Committee to implement GIRO in the country and has been involved in the implementation of new e-Treasury system in the Reserve Bank. He was also involved in the operationalisation of the first of its kind ISO 20022 standards based RTGS System and the digitisation of payment transactions.

Padmanabhan was also the Chairman of the Technical Committee on Services/Facilities for Exporters and a part of the think tank to manage market volatility, as well as a member of the Governing Council of the Institute for Development & Research in Banking Technology, a banking research institute established by RBI. He represented RBI in the Committee on Payment and Settlement Systems, Basel and was also inducted into the Steering Group of the CPSS-IOSCO for Review of Standards.

As a member of the Working Group of the CPSS, Basel, Padmanabhan worked on the report on Principles for Financial Market Infrastructures and also chaired the International Working Group set up by CPSS(now CPMI) on Non-banks. He was one of the persons responsible for drafting the Sodhani Committee's report in 1995 on the foreign exchange market and measures for widening and deepening the market, and has supervised the revision of the Internal Control Guidelines for Foreign Exchange Business in 1996. Padmanabhan was also a member of the internal group that prepared and submitted a Technical Paper on Asset -Liability Management for Indian banks which was accepted by the Bank and formed the basis for Reserve Bank of India's initiative.

On superannuating while holding position of Executive Director from the RBI, Padmanabhan was appointed as Non-Executive Chairman of Bank of India in Aug 2015. He held this position for 5 years till Aug 2020. Padmanabhan advises several firms on banking/ foreign exchange and payment system and other regulatory issues. He also holds Board positions in Axis Bank, Aditya Birla Sunlife AMC Trustee Board and in Haldyn Glass.

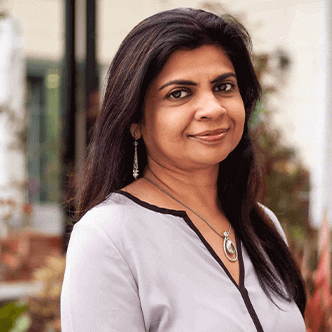

An Economist by training, Anna is a post-graduate from Delhi School of Economics and an Economics (Hon) from SRCC. She worked as a Lecturer in Delhi University and Research Associate in TERI before joining the Indian Economic Services (IES), Government of India. Within the Government, she has worked in various senior capacities in Ministry of Finance and Ministry of Civil Aviation. She is currently working as a Senior Adviser and Head of Department (Data Management & Analysis) in NITI Aayog. She heads the Women Entrepreneurship Platform launched by NITI Aayog on March 8, 2018. She also leads the Artificial Intelligence (AI), Block chain initiative of NITI Aayog. She has experience in wide range of subjects in Infrastructure, PPPs and Banking sector, etc.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

(1).png)

.png)

.png)

.png)

.png)

.png)

(1).png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

National Payments Corporation of India (NPCI) was incorporated in 2008 as an umbrella organization for operating retail payments and settlement systems in India. NPCI has created a robust payment and settlement infrastructure in the country. It has changed the way payments are made in India through a bouquet of retail payment products such as RuPay card, Immediate Payment Service (IMPS), Unified Payments Interface (UPI), Bharat Interface for Money (BHIM), BHIM Aadhaar, National Electronic Toll Collection (NETC Fastag) and Bharat BillPay.NPCI also launched UPI 2.0 to offer more secure and comprehensive services to consumers and merchants.

NPCI is focused on bringing innovations in the retail payment systems through use of technology and is relentlessly working to transform India into a digital economy. It is facilitating secure payments solutions with nationwide accessibility at minimal cost in furtherance of India's aspiration to be a fully digital society.

For more information, visit: https://www.npci.org.in/

Payments Council of India was formed under the aegis of Internet and Mobile Association of India (IAMAI) in the year 2013 catering to the needs of the digital payment industry. The Council was formed inter-alia for the purposes of representing the various regulated non-banking payment industry players, to address and help resolve various industry level issues and barriers which require discussion and action. The council works with all its members to promote payments industry growth and to support our national goal of 'Cash to Less Cash Society' and 'Growth of Financial Inclusion' which is also the Vision Shared by the RBI and Government of India. PCI works closely with the regulators i.e. Reserve Bank of India (RBI), Finance Ministry and any similar government, departments, bodies or Institution to make 'India a less cash society'.

For more information, visit: http://paymentscouncil.in/

Fintech Convergence Council (FCC) after successfully hosting the largest Virtual Fintech Conference - Global Fintech Fest in the month of July 2020, and partnered with the Monetary Authority of Singapore (MAS) as Global Satellite Event Partner for Singapore Fintech Festival (SFF) 2020 to host the India leg of Singapore Fintech Festival (SFF). The India Leg of Singapore Fintech Fest (SFF) was organized by FCC and UNCDF jointly.

Fintech Convergence Council (FCC) represents the FinTech industry and traditional companies in the BFSI space. The purpose of the council is to encourage collaboration, seek complementarities and build synergy between leading BFSI companies and the emerging FinTech start-ups. The council has worked towards interpreting the regulatory and legal framework, aggregating the concerns and feedback of the various players within the larger FinTech community, communicating it to regulators and lawmakers, and organizing events and gatherings for the industry participants to meet, share ideas and work together in the interest of creating a safer, more open and more collaborative operating environment through a transparent forum. The vision of the council is to "To proactively work towards growth of fintech and penetration of financial services to support our national goal of financial inclusion, moving towards a digitally empowered country."

It has been the endeavor of FCC to showcase India's Fintech landscape to the world, and no better platform than the Singapore Fintech Festival. The agenda brought together who's who from the Indian Financial space over the 5 day event. The line up of events also included a curated session matching Indian start-ups with global investors. The Deal Friday platform provided a unique opportunity to early-stage fintech start-ups from India to pitch and have one on one meetings with a broad spectrum of investors looking for investment opportunities in India.

For more information, visit: https://www.fintechcouncil.in/

.jpg)

.JPG)